You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to List5 Predictions for the 2021 Housing Market

January 12 2021

Following one of the strongest years for residential real estate on record, the 2021 housing market has some large proverbial shoes to fill. Both home sellers and buyers fared well in 2020; median home sale prices reached a record $304,100, surpassing $300,000 for the first time in history, while mortgage rates hit record lows.

Following one of the strongest years for residential real estate on record, the 2021 housing market has some large proverbial shoes to fill. Both home sellers and buyers fared well in 2020; median home sale prices reached a record $304,100, surpassing $300,000 for the first time in history, while mortgage rates hit record lows.

Optimistic housing economists expect a recovering national economy to improve the housing market even more in 2021. They see it motivating sellers who sat on the sidelines in 2020 and restoring confidence to buyers who did the same. Some housing forecasters have even predicted that 2021 will be a better year for residential real estate than 2020.

Not everyone agrees with the rosy outlook, however.

In a September 2020 report, William R. Evans, an assistant vice president and economist at the Federal Reserve Bank in St. Louis, argued that negative housing signals are accumulating. These include rising mortgage delinquencies and foreclosures, banks' increasing loan loss provisions to protect them from defaults, tightened lending standards, and a drop in consumer confidence.

With so many factors at play, what can we truly expect for 2021 housing market? Here are five predictions:

Rates will rise slightly as the economy recovers but will remain historically low.

The forces that triggered this era of historically-low mortgage rates were at work years before the pandemic arrived and will likely stay with us post-COVID-19. However, the pandemic has made its mark on the real estate economy, and the 2021 housing market may bring the end to rates below 3%.

The Mortgage Bankers Association's (MBA)'s baseline forecast for 30-year fixed-rate mortgages calls for rates to increase modestly this year, opening at 3% and rising to 3.3% by the end of the year and reaching 3.6% by the fourth quarter of 2022. Fannie Mae's chief economist Doug Duncan believes that rates will stay low for a significant period and that the mortgage rate is "going to be very good" for households. NAR held a forecast summit in December for 20 leading economists, who agreed that 30-year fixed mortgage rates will reach 3.25% in 2021.

Prices will rise, but at a slower pace than in 2020

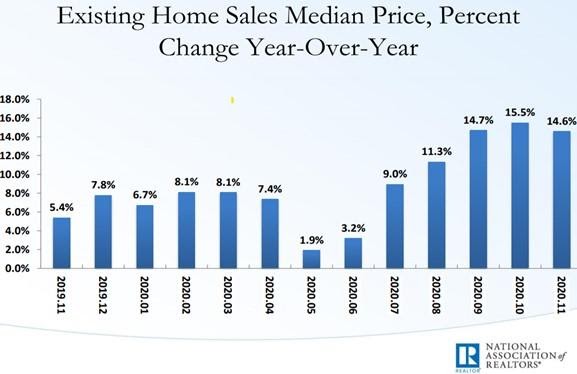

Home prices in November 2020 were 14.6% higher than in November 2019. This trend began over three years ago, long before the pandemic. Home price appreciation reflects demand driven by low rates, though demand has grown during the pandemic.

In mid-December, housing and economic experts surveyed by NAR concurred that the 2021 housing market will see home prices grow 8%.

However, the real estate analytics firm CoreLogic believes pressure on home supplies could moderate home price growth in 2021. The CoreLogic HPI Forecast expects home prices to slow to only 1.9% by October 2021, depending on the recovery speed. CoreLogic predicts that 2021 would bring the first price decline in nine years.

Source: National Association of Realtors

New home sales will increase but not enough to meet demand

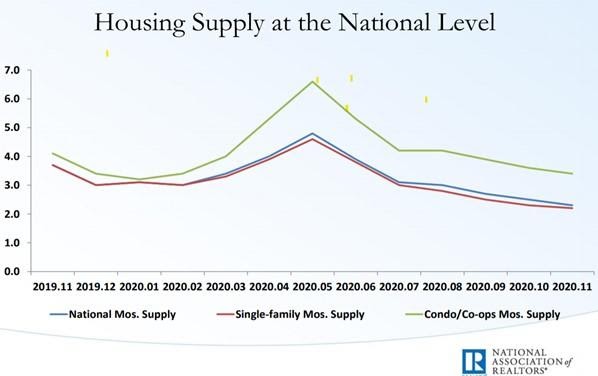

Housing markets boomed until the fourth quarter in 2020, when inventory shortages tempered sales. From November 2009 to November 2019, the nation's monthly supply of single-family homes for sale declined 48%; by November 2020, it fell another 27%.

As inventory shortages have increased, new home construction has not sufficiently kept up with demand. New home sales, accounting for about 10% of annual home sales, was decimated by the Great Recession, and it's taken builders years to recover. Additionally, environmental and land-use restrictions slow the building of new developments in suburban locations and builders are struggling with shortages of lumber and skilled labor.

Still, homebuilders made significant contributions to home supplies in 2020. By November, new home sales were 20.8% higher year-over-year, while single-family homebuilding, the largest share of the housing market, rose to its highest level since April 2007. Will it be enough in the 2020 housing market? Experts aren't too confident.

"The new home sales numbers had a big jump in 2020, and there will be more growth in 2021, but they're going to have to rebuild that inventory because anything that the builders are building today gets sold," says Fannie Mae's chief economist Doug Duncan.

"Despite the best intentions of home builders to provide more housing supply, the ‘big short' in housing supply will continue into 2021 and likely keep house price appreciation flying high," says First American's Mark Fleming.

Affordability will decline in 2021, and multigenerational homes will become even more popular among first-time buyers

In the early months of the pandemic, as mortgage rates reached their lowest levels since 2013, first-time homebuyers enjoyed improved housing affordability and breathed new life into the market.

In April, the first-time buyer share of sales reached 36%, far higher than the 31% annual average in 2019. By October, however, this share fell to 32% as affordability declined. One result of this decline was an increase in multigenerational home purchases, which accounted for 15% of sales after March compared to 11% for those closed beforehand.

Lawrence Yun at NAR expects mortgage rates will increase by 3.5% in 2021, and that home prices will rise by 3% in 2021.

"The coronavirus without a doubt led home buyers to reassess their housing situations and even reconsider home sizes and destinations," said Jessica Lautz, vice president of demographics and behavioral insights at NAR.

The pandemic will increase relocation

The pandemic shifted millions of Americans into work-from-home scenarios in 2020, leading to a migration from city centers to less densely populated areas. The 2021 housing market looks poised to continue that trend, as many companies have decided to maintain or implement more remote-work operations for their employees.

A recent Homes.com study showed the ability to eliminate commuting as a factor in home or rental choices has substantially revised consumers' location requirements, with 32% of agents and brokers reporting city-to-suburb moves as the #1 change and 23% ranking fewer requests for proximity to public transportation or highways in the #2 spot.

The study also found that 40% of consumers who have moved within the last year or plan to move within the next are relocating more than 100 miles away, with half of those moving over 500 miles away.

"The surge in the work-from-home population has rewritten the playbook for many homebuying and rental decisions, from when and where to relocate, to what people are looking for in their next residence," said Homes.com President, David Mele. "That, in turn, is prompting changes for real estate professionals, many of whom are expanding their market area to better serve clients who are moving farther than before. If working from home becomes standard operating procedure for many companies, as predicted, these changes will be with us for years to come."

Steve Cook is the editor of the Down Payment Report and provides public relations consulting services to leading companies and non-profits in residential real estate and housing finance. He has been vice president of public affairs for the National Association of Realtors, senior vice president of Edelman Worldwide and press secretary to two members of Congress.

Steve Cook is the editor of the Down Payment Report and provides public relations consulting services to leading companies and non-profits in residential real estate and housing finance. He has been vice president of public affairs for the National Association of Realtors, senior vice president of Edelman Worldwide and press secretary to two members of Congress.

To view the original article, visit the Homes.com blog.