You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListConsumers Think Home Prices Will Decline. Are They Correct?

October 16 2022

Consumer real estate sentiment is shifting fast: After two years of soaring home prices, consumers are more likely to think home prices will decline than will rise over the next year.

Consumer real estate sentiment is shifting fast: After two years of soaring home prices, consumers are more likely to think home prices will decline than will rise over the next year.

What does this mean for your clients? Should prospective buyers and sellers anticipate falling home prices? How can you answer questions about home prices, or set expectations for local consumers who are planning to buy or sell now or in 2023?

Here's what to know about the state of consumer housing sentiment and the future price of homes.

Why Do Consumers Think Housing Prices Will Fall?

The last two times a higher percentage of consumers believed housing prices would decrease rather than increase were 2011, in the aftermath of the housing market meltdown, and early in 2020, as the COVID-19 pandemic began.

In those instances, huge events shook the economy and caused tumult in the housing market. Now, a new event is rocking real estate, dampening consumer sentiment, and leading to the expectation of lower housing prices: rising mortgage rates.

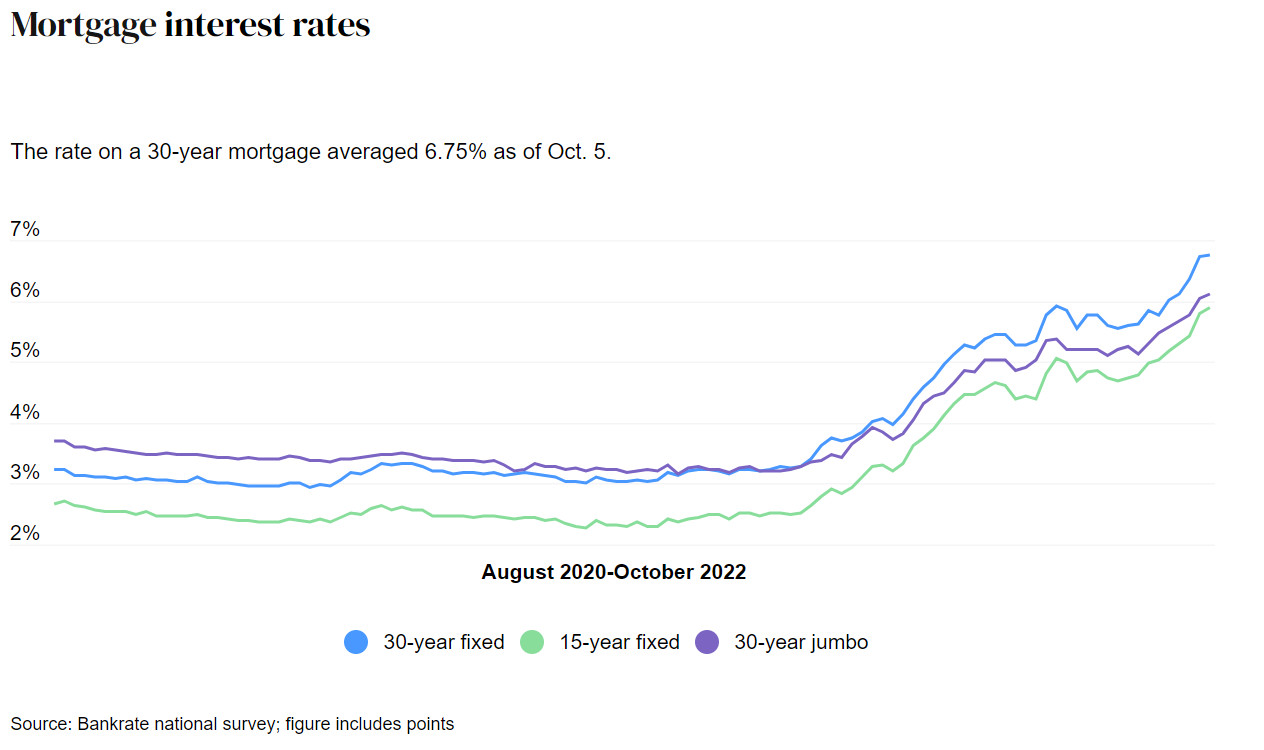

Mortgage rates have more than doubled in the past year, and haven't been this high since 2008.

The ultralow mortgage rates of 2020 turbocharged buyer demand and resulted in a historic jump in home prices. Now that mortgage rates are up, demand is down, and less demand typically means lower prices.

You shouldn't be surprised if buyers and sellers also figure that mortgage rates are set to rise further. After all, the Federal Reserve has been clear that it will raise interest rates until inflation abates, and rising interest rates usually drive up mortgage rates.

Will Housing Prices Fall?

You can't blame consumers for thinking that home prices are due for a decline. But consumer expectations don't mean that home prices will actually decrease in your local market.

Probably the most important reality of the current housing market is that there are more people who want to buy a home than homes available. This housing shortage goes back to the Great Recession, which depressed homebuilding and made "starter homes" hugely difficult to find.

Bidding wars may be less common now than last year, but home shortages mean that when a property goes on the market, there are usually multiple buyers willing to make an offer.

Another trend working against the possibility of falling home prices is the glut of millennial buyers entering the market. These buyers in their 20s and 30s are getting married, looking for space, and ready to invest their equity into property. Young buyers with the means are still going to want to buy homes, even if they have to agree to an adjustable-rate mortgage (ARM), buy discount points, or plan to refinance when rates drop.

Some super-hot pandemic-era markets may see home prices decline, but larger market forces suggest that nationwide, home price growth will continue at a tapered pace.

For sellers, the likelihood of home price growth means that it is still a good time to buy a home. For buyers, now is the time to get in the market. If prices and mortgage rates rise together, it will be better to buy now than in six or 12 months. For agents, understanding consumer expectations are different than agreeing with them. Be ready to explain to clients that their low sentiment about the housing market doesn't necessarily equal lower home prices.

To view the original article, visit the Homesnap blog.