You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListThings Are Looking Up for the Housing Market

February 12 2023

Well, would you look at that: the housing market is showing signs of life and things seem to be looking up!

The housing market is currently experiencing a period of growth, with prices rising at an unprecedented rate. This market trend is being driven by numerous factors, with some of them being lower mortgage rates, a strong economy, and a lack of available housing on the market.

Lower mortgage rates

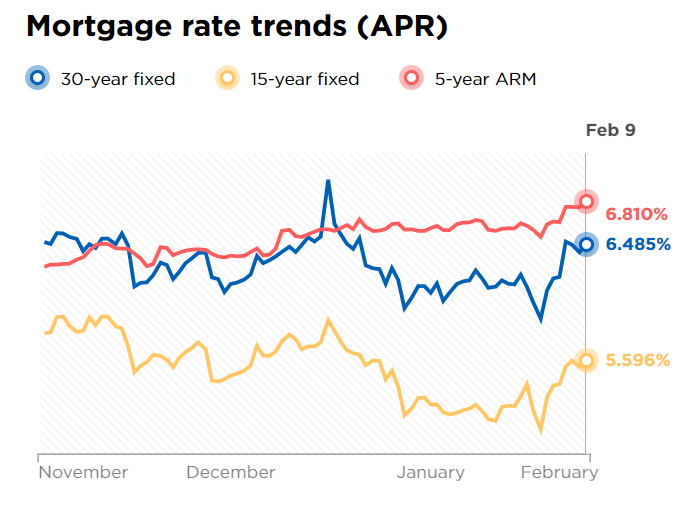

One of the key drivers of the housing market is the current lower mortgage rates. The Federal Reserve has kept interest rates at historic lows in the past in order to stimulate the economy and encourage borrowing. This has made it more affordable for people to purchase homes, which has led to increased demand for housing. With higher fed rates, it has pushed rates to all-time highs, but we can see rates coming back down into the 5%-6% range.

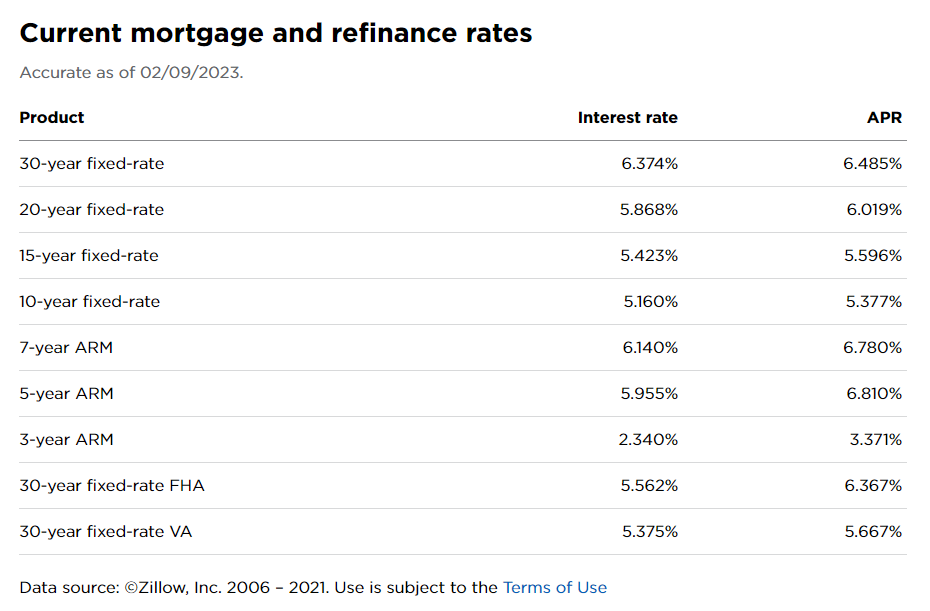

(Charts from Nerdwallet)

Based from these charts from Nerdwallet, some key lower mortgage rates to look at are the 20-year fixed-rate at 5.868%, the 15-year fixed-rate at 5.423%, the 10-year fixed-rate at 5.160%, the 30-year fixed-rate FHA at 5.562%, and the 30-year fixed-rate VA at 5.375%.

The strong economy

Another factor that is contributing to the housing market's rapid growth is the strong economy. The unemployment rate is at a 50-year low, and wages are rising. This is giving people the confidence and financial means to make large purchases, such as buying a home. Additionally, the stock market over the last 10 years has been performing well, which has also given people more disposable income to invest in real estate.

Lack of available housing

A third factor that is driving the housing market is a lack of available housing. As the economic principle stands, more demand = less supply. The population is growing, and the number of new homes being built is not keeping pace with demand. This, in turn, has led to a shortage of housing, which is driving up the prices of homes. Additionally, the pandemic has accelerated the trend towards remote working, which has increased the demand for homes in less urban areas.

But wait, is there cause for concern?

With lots of highs comes lots of lows as well — some first-time home buyers, and those with lower incomes, have cause for concern with the rising home prices. The high prices can make it difficult for these groups of people to enter the housing market, which can have a negative impact on the economy. Additionally, the high prices can put a strain on the budget of those who are able to purchase a home, leaving them with less disposable income to spend on things they would usually be allocating budget for.

However, despite these concerns, the overall outlook for the housing market is positive. The economy is strong, and the lower mortgage rates are expected to continue, which will continue to drive demand for housing. Additionally, the lack of available housing is expected to be addressed in the coming years, as more homes are built to meet the growing demand.

It's worth noting that while numerous articles have been talking about the growth of the U.S. housing market, similar trends are also being observed in other developed countries. Low interest rates, strong economies, and increasing populations are also driving up housing prices in these countries.

In conclusion, the housing market is currently experiencing a period of growth — driven by lower mortgage rates, a strong economy, and a lack of available housing. While this has caused concerns amongst various groups of people, like first-time home buyers and those with lower incomes, the overall outlook for the housing market is and looks like it will continue to be positive. As always, it is important for us to keep an eye on the market.

To view the original article, visit the Transactly blog.