You are viewing our site as an Agent, Switch Your View:

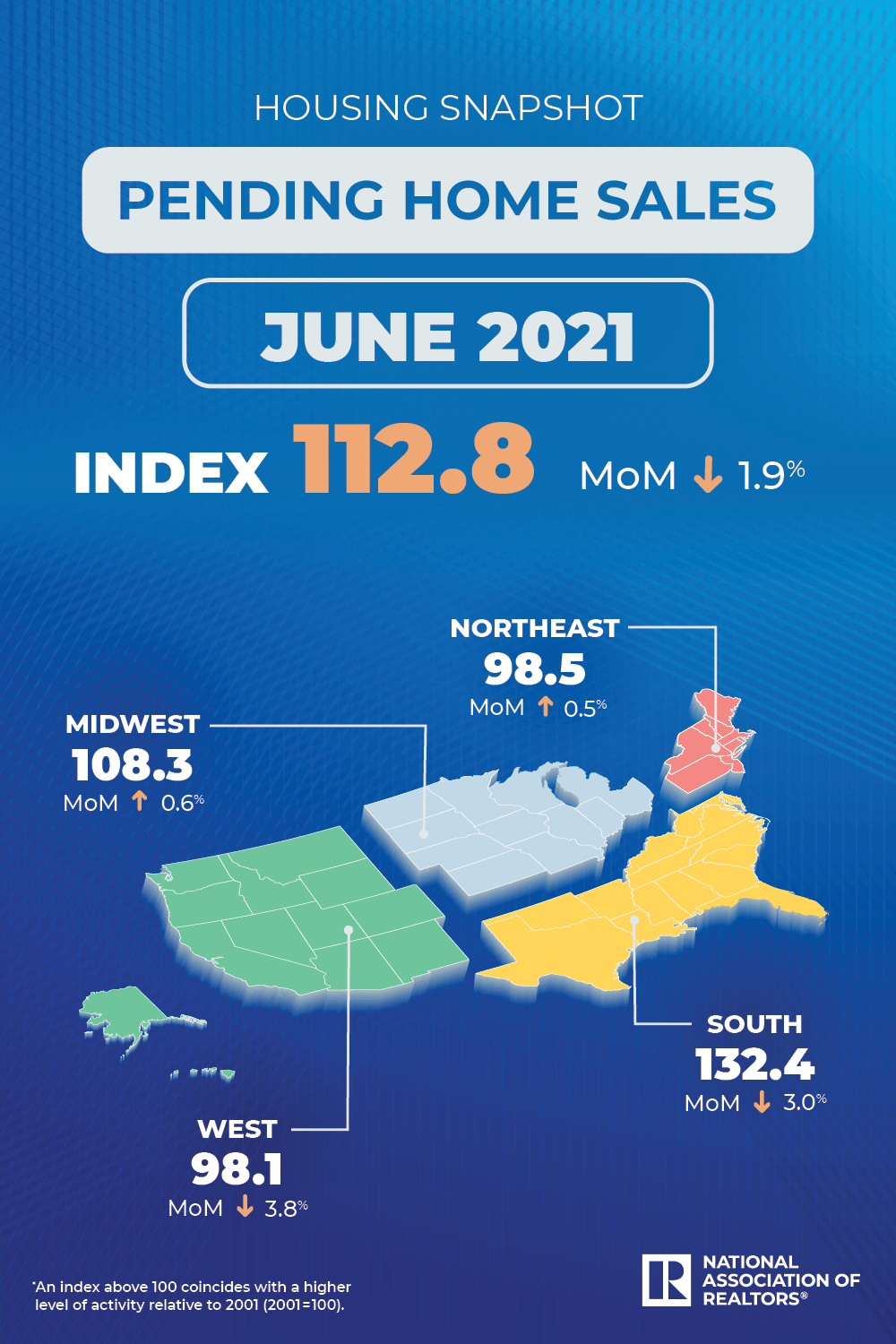

Agent | Broker Reset Filters to Default Back to ListPending Home Sales Fall 1.9% in June

July 29 2021

Compared to the month before, contract signings rose in the Northeast and Midwest but fell in the South and West.

WASHINGTON (July 29, 2021) -- Pending home sales declined marginally in June after recording a notable gain in May, the National Association of Realtors reported. Contract activity was split in the four major U.S. regions from both a year-over-year and month-over-month perspective. The Northeast recorded the only yearly gains in June.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 1.9% to 112.8 in June. Year-over-year, signings also slipped 1.9%. An index of 100 is equal to the level of contract activity in 2001.

"Pending sales have seesawed since January, indicating a turning point for the market," said Lawrence Yun, NAR's chief economist. "Buyers are still interested and want to own a home, but record-high home prices are causing some to retreat.

"The moderate slowdown in sales is largely due to the huge spike in home prices," Yun continued. "The Midwest region offers the most affordable costs for a home and hence that region has seen better sales activity compared to other areas in recent months."

June Pending Home Sales Regional Breakdown

The Northeast PHSI increased 0.5% to 98.5 in June, an 8.7% rise from a year ago. In the Midwest, the index grew 0.6% to 108.3 last month, down 2.4% from June 2020.

Pending home sales transactions in the South fell 3.0% to an index of 132.4 in June, down 4.7% from June 2020. The index in the West decreased 3.8% in June to 98.1, down 2.6% from a year prior.

Yun forecasts that mortgage rates will start to inch up toward the end of the year. "This rise will soften demand and cool price appreciation."

"In just the last year, increasing home prices have translated into a substantial wealth gain of $45,000 for a typical homeowner," he said. "These gains are expected to moderate to around $10,000 to $20,000 over the next year."

According to Yun, the 30-year fixed mortgage rate is likely to increase to 3.3% by the end of the year, and will average 3.6% in 2022. With the slight uptick in mortgage rates, he expects existing-home sales to marginally decline to 5.99 million (6 million in 2021). Yun added that, with demand easing and housing starts improving to 1.65 million (1.565 in 2021), existing-home sales prices are expected to increase at a slower pace of 4.4% in 2022 (14.1% in 2021) to a median of $353,500.

The National Association of Realtors® is America's largest trade association, representing more than 1.4 million members involved in all aspects of the residential and commercial real estate industries.