You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListPredictions for 2019 in Real Estate

March 04 2019

Over the past five years, venture capital has poured into the real estate sector creating exciting new technologies, establishing new brands, and expanding the abilities for both professionals and consumers. Chief among them are the integration of artificial intelligence, the growth of Compass, additional lines of business for Zillow, and proliferation of a consumer-first attitude when it comes to technology development.

Over the past five years, venture capital has poured into the real estate sector creating exciting new technologies, establishing new brands, and expanding the abilities for both professionals and consumers. Chief among them are the integration of artificial intelligence, the growth of Compass, additional lines of business for Zillow, and proliferation of a consumer-first attitude when it comes to technology development.

Backed by a ten-fold increase in VC dollars, there are significant trends that have lots of wind in their sails. Here are some of my predictions for how this will play out in 2019 (and beyond):

- Consumer Engagement Takes Center Stage

- Platforms > Pipelines

- Seed Stage Capital Tightens

- The Team Model Continues to Define the Future

- iBuyers Grow Then Slow

- Private Listing Value Declines

Consumer Engagement Takes Center Stage

For NAR, the main concern with consumer technology of late has to do with actually mitigating its negative effects, particularly for sellers. Nobu Hata, director of member engagement for the association, noted that clients are immediately targeted by spammers and scammers when they begin the real estate process. "You become a target as soon as your home goes on the market," he said, noting that NAR has launched a series of campaigns to educate consumers and members about the risks, telling them, "this is how you can prepare for it."

I listened in to a recent webinar with the incoming NAR president that outlined the primary 2019 objectives for the organization. The number one objective is broker-consumer engagement. It's no secret that communication and engagement is the most common struggle in the industry, and I strongly believe in NAR's placement of this at the top of the list. From NAR's perspective, it is as much about the obvious need for providing high quality customer service as it is recognition that the reputation of agents is on the line with the growth of technology and the control consumers have over their home buying and selling process. What does this look like?

Machines can't sit down, drink coffee, and walk clients through the largest investment decision of their life

Besides the obvious of providing guidance and being more responsive, there are two examples that bear this out through well known offerings: Agent-matching services like Homelight and Zillow's concierge service. For the former, the goal is to match consumers to agents and monetize that referral. The existence of a two-sided platform that helps consumers find the best agent has merits, but is the execution lacking when it comes to the consumer experience?

I went on the platform, answered the survey questions, and received three matches. Without agreeing to click through and 'connect' with the agent, Homelight called me several times, my information was passed to each of the three brokers who then called and texted me several times over the following week. I had no true understanding of why that broker was recommended and the broker received a very low-quality lead (I called or emailed each to let them know I wasn't a lead and to apologize). The problem is that for these services, their lifeblood is leads so they are incentivized to pass as many leads (read: quantity over quality) to as many brokers as they can. This creates a poor experience for the consumers (I'm uncertain why they were chosen; my information is passed along before I felt like I committed) and brokers (lead quality is suspect, and it can be a frenzied scramble to respond to the lead first).

Along the lines of lead quality, Zillow is stepping up its efforts to screen leads before passing them to agents. This sounds genuinely valuable, but looking at the mechanics creates some issues.

Curt Beardsley, vice president of industry relations for Zillow, said they are concentrating on ways to reduce the stress of the home buying and selling processes. He said one way they're trying to reduce this stress is to make agents easier to reach. Their company takes incoming calls from consumers and matches them with a live agent on the other end who can answer their questions immediately. "If you actually make a one-on-one connection, [you have a] significantly higher chance of actually going to a closed transaction," Beardsley said.

Zillow claims that once they screen the lead, presuming they're "high quality," they pass off the information to an agent. If the agent doesn't answer the phone, it goes to the next agent, and so on (with, I believe, the ability for the first agent to reclaim the lead). Sounds like an improved Premier Agent experience.

But what about the consumer? My information is rifled through a roster of agents who, at this point, I have no idea anything about or why they may be a good fit other than they paid Zillow to get in line.

What's missing is providing the consumer the ability to understand who is a good agent and why — not just understanding who is a good lead and why.

Could a slightly different business model help?

Platforms Over Pipelines

This is perhaps my favorite emerging trend. Traditionally, real estate tools and services have been almost exclusively broker-benefitting. This has lead not only to the MLS striking out on the chance to develop Zillow, but a slew of single-feature tools. If brokers were to strap on a metaphorical tool belt containing all the tools they use throughout a transaction, few people would be able to stand.

Conversely, technology providers that try to do it all rarely do anything well. How can companies, such as Homebloq, balance the equation? Look no further than the prior prediction — consumers. This does not mean simply building consumer-facing tools (does anyone want to take on Zillow directly?), but refactoring your technology through the lens of the consumer as much as the broker.

What is necessary to provide the consumer a better experience? A broker-facing search platform? Tools that allow brokers to pair consumer data (search histories, credit events) to a personal identity in your Rolodex to fire off spam? Communicating across emails, texts, MLS tools, apps, and phone?

Too often, technology that is developed by brokerages assumes the broker as the ultimate end user, providing less utility to the actual end user—the client. This exists when tools load up on broker-only features and sacrifice the client experience. Here are a few examples that have these sorts of unintended consequences:

- No ability for consumers to drive their own searches (many MLS tools — are we surprised clients abandon them and revert to Redfin?)

- Tools that make it easier for consumers to get spammed (broker marketing tools)

- Private Listing Networks (more below)

Truepad, a defunct Chicago startup, was headed in the right direction. The app's goal was to solicit broker's opinion about listings and share that with consumers. I believe this failed for two reasons:

- Soliciting opinions is a feature, and it's hard to build a product, let alone a company around a feature.

- Brokers do not want their personal opinions, which in this case represent their intellectual property, shared publicly.

Homebloq's client-friendly search platform intends to benefit from a broker-only network on top of it that facilitates connections and information sharing among professionals, creating enhanced communication not only between agents and clients, but among the agent community. Can startups come in from outside the industry, ignoring the status quo bias, and shake things up for the consumer? Is the capital there to enable it?

Seed Stage Investment Capital Tightens

As rates and the Washington boat rocks back and forth, the probability recession coming in the medium-term future continues to rise. The capital markets have already had a peak-to-trough of 20 percent and the bull market will come to a close eventually. With that, it is clear that early stage capital in the space is shifting towards later stage companies (Knock, OpenDoor, Compass, etc.), so while the absolute figures are staggering, it is highly concentrated, making truly new innovation more challenging.

As large amounts of money continue to chase fewer opportunities, a bottleneck will likely occur in innovation. Tools that are created to disintemediate the agent will be the first to fail and those that rely too heavily on machine learning and artificial intelligence with little thought into practical application and usability will also fail. Those that enable the agent and provide utility to the consumers will succeed, and those that derive value from the interactions among its users will be in the top performing group.

The Team Model Continues to Define the Future

Traditional brokerage models will continue to go by the wayside as the team model emerges. The latter provides opportunities for specialization, including the potential to leverage technology more efficiently with roles focused on learning and leveraging it (do you have a technologist on your team?).

As pressure on commissions continues, specialization and creation of niche offerings will be critical to long term survival. Just like technology companies who do few things well when trying to do them all, brokers who continue to be mediocre on average will exit the marketplace. Team leaders who can structure teams to optimize lead generation, client engagement, and process management through experts and technology have not only the ability to survive, but thrive.

iBuyers Grow Then Slow

In strong markets, iBuyers face less risk because they are trading on certainty — as a buyer, they are providing comfort and ease; as a seller, capitalizing on a continuing healthy market to net a profit. In slower markets, they are providing liquidity. Market makers in the stock market act in a similar manner, offering to buy shares and then resell them at a higher price (setting the difference through the bid-ask spread which is known). A key difference here is the velocity of change in the stock market, which is much faster than the housing market. When markets are trending down, the spreads iBuyers will be able to maintain will continue to shrink, and their inventory is likely to skew.

In this excellent talk, Alex Rampell, of West Coast VC Firm Andreessen Horowitz, argues that in the future, buyers will sell their homes to a company, touting the technological advantages, transparency, and certainty that iBuyers provide. Extending this further, what's stopping Keller Williams, with its larger network of clients and brokers (and geographic presence) from entertaining this business model in full? While this keeps agents in the fold, it presents competitive threats to the pure iBuyers. In the coming weeks, we'll discuss who wins and loses with the iBuyer model—but suffice it to say, I am not sold on the economics of the iBuyer business model over the long term for a few reasons:

-

Competition = Margin Compression: This is already a razor thin margin game (Zillow in its latest annual earnings took a net loss of $27.2M on revenues of $41M in the fourth quarter in its 'Homes' segment), and as more consumers entertain the idea of a guaranteed seller, more firms will enter the market, driving down margins, especially because the model suffers from:

-

Negative Network Effects: If the model continues to grow in popularity, as more firms enter, the value-add as a differentiator drops. Consumers will be better able to comparison shop among iBuyer offers and:

-

iBuyers Become Buyer of Last Resort: Here's a likely "workflow" for home sellers—try it themselves via FSBO. If no luck, then solicit offers from iBuyers to know the absolute floor price for which you can sell, then list with an agent. If the offers the agent brings in, less the commission, are lower than the iBuyer offer, less their fee, swap to the iBuyer. If not, use the agent. This, as we'll discuss in the coming weeks, is a not-talked-about-enough relationship between agents and iBuyers.

"We are sharing our three- to five-year targets that reveal what we believe will be a much larger, integrated online real estate company in which our Homes segment alone can add $20 billion in annual revenue."

- Zillow's 10-K

How confident is Zillow in iBuyers? From $41M last year, they envision this being a $20 billion dollar annual revenue channel in three to five years. In the fourth quarter of 2018, big Z purchased 499 homes and sold 141, and currently holds 509 homes in inventory at an approximated $162.8 million in value. Notably, Zillow says, "since Zillow Offers launched in April 2018 ... Zillow Offers is currently available in 7 markets with plans announced to be in at least 14 by the end of 2019. After less than a year, Zillow currently receives a request for a Zillow Offer every 5 minutes, which translates to an estimated $100 million in demand value per day."

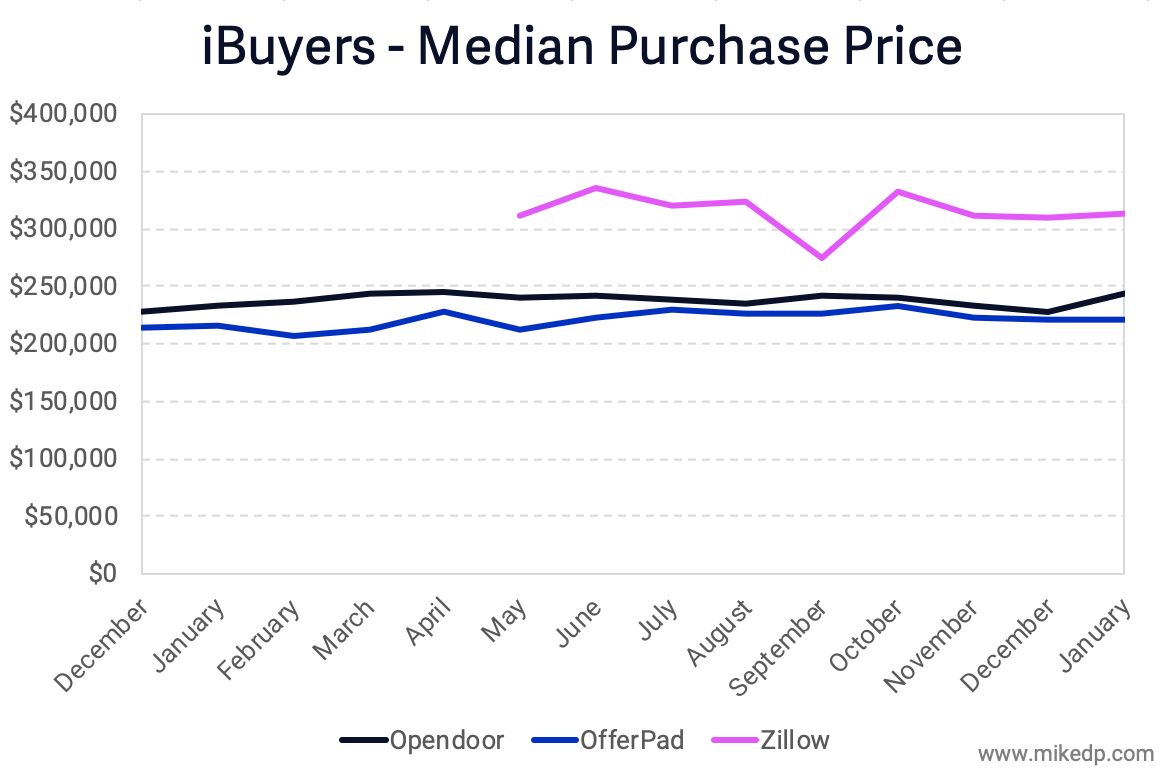

$100M every day in demand. That's $35.5B annualized over a full calendar year. Now, bring in competition, differentiate between me just clicking to see what I could get but not interested in actually selling and a serious seller, far from flawless execution, and changing market economics—oh, and expenses... lots and lots of expenses. For Zillow to hit that target, they have to execute near perfectly. One advantage Zillow has, as Mike Delprete notes, is operating at higher price points (which, as he notes, also means longer sales cycles—more expensive homes just take longer to sell, on average).

In the end, I'm bearish on a razor-thin margin business model in a super-cyclical industry taking a big chunk of the industry, but if I had to bet on one horse in this race, it's big Z.

Private Listing Value Declines

The value of private listings will decline for two reasons. First, as the market continues to shift from a seller's to a buyer's in most areas across the country, the bidding on pocket listings will slow as demand (and urgency) decreases. Time slows down as markets slow, and while there is certainly value in getting a property in front of other agents and brokers for information and feedback, the incentive to make offers on such properties becomes less so, ultimately eroding the value-add of participating in a network like TAN. TAN is wise to charge agents a flat fee for its use, not relying on volume within what is obviously a cyclical sector.

Secondly, private listings suffer from negative network effects because when more brokers that have access to and market pocket listings, they simply become less exclusive and valuable. This, I suspect, is the true (or at least a major, but unsolicited) motivation to capping private listing networks at some top X percent of performers or retaining them in-house (because the argument against —Don't sellers want all eyes to have access to collect as many offers as possible? — can defeat the value of private listings to consumers).

Ultimately, client service and guidance will be differentiators among brokers, especially as markets shift. We've already argued that real estate is getting small again and how what was once a sleepy industry got big with the advent of the internet and is now reversing course as agents find value-add in carving out niches, creating teams with specialists, and creating an advantage through hyper-local knowledge.

So what do you think? How does my vision align with yours?

To view the original article, visit the Homebloq blog.