You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListUnintended Consequences

October 14 2014

WAV Group has been studying listing syndication for a long time. We have observed that the listing syndication strategy has been hugely successful at supporting the brokerage firm from exiting the expensive and largely underperforming newspaper advertising demand by sellers. The first week of the month is the period of time that I sit in on a number of brokerage management and board of directors meetings. At each meeting I am asked the same question: "Do sellers request newspaper advertising anymore?" The answer is a resounding "NO!"

WAV Group has been studying listing syndication for a long time. We have observed that the listing syndication strategy has been hugely successful at supporting the brokerage firm from exiting the expensive and largely underperforming newspaper advertising demand by sellers. The first week of the month is the period of time that I sit in on a number of brokerage management and board of directors meetings. At each meeting I am asked the same question: "Do sellers request newspaper advertising anymore?" The answer is a resounding "NO!"

The removal of the expense of advertising in the newspaper was a huge windfall for brokerage firms. One client removed $6,000,000 from their advertising budget over a period of years as they transitioned from print to web – which equated to about $100 per month per agent. Today, they have parlayed that savings into a suite of productivity solutions and online marketing and have dropped that number from $100 per month to less than $50. Better yet, the results are better. Today consumers ask their agent how they are going to market their company online, not in the newspaper. It is a huge win for all parties concerned.

WAV Group consults not only with brokerages but also with MLSs. MLSs want to deploy strategies that strengthen the participant and subscribers' connection to the consumer, and listing syndication is an important service. Some MLSs do not agree, and have dropped listing syndication altogether taking the stance that the consumer has many options to access real estate listing content on agent and broker websites. Who needs portals?

Other MLSs support listing syndication, but want to make it better. One strategy that has been successful is to treat the data that goes to portals as a classified ad. Don't send all of the data. Send a set of the data that drives the consumer to respond to the ad. In the case of portal advertising, ad response comes in many flavors: click to the broker website, request for more information, request for a showing, agent ratings, etc.

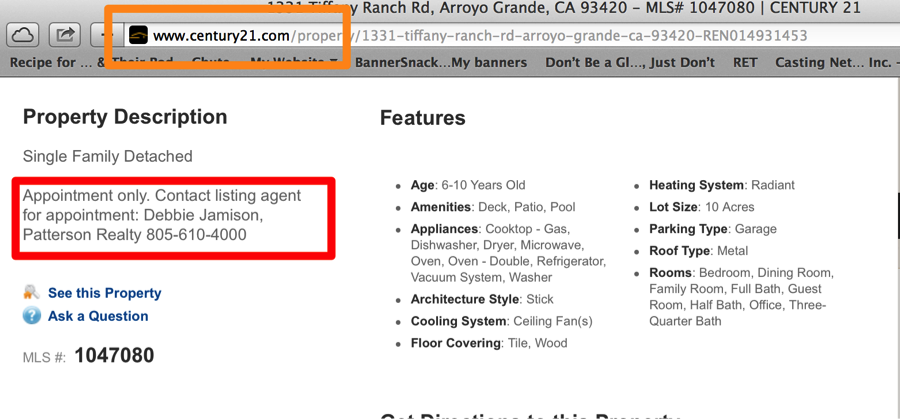

This strategy involves modifying and truncating the data to suppress information on portals and bluster information on broker and agent websites. For example, only sending a few photos makes the consumer want more, and they will click to get more if they are interested in the house. If the agent wants the phone or inbox to ring, they need to have their phone number and email address displayed. Since a lot of portals charge for this service, the way around the charge is to insert the Agent's name, number, and email address in the description text. These are tricks to generate better response without driving up costs.

There is a new category of hybrid portals. They are portals owned by franchises. Franchises cannot display the full IDX feed like brokers can because they are not MLS subscribers. As such, they are treated like third party websites, although they seem to be in a category that is in the middle between sites like Zillow and broker sites. That is why I think of them as a hybrid. You will find them in the ListHub dashboard; they fall under a set of rules called Franchise Real Estate Network Display Rules. Participants include ColdwellBanker.com, RealtyExecutives.com, remax.com, and Century21.com.

These are huge websites that, in aggregate, compete with the big portals for consumer traffic. Much in the same way that IDX allows the network of participating brokers to share data, the Real Estate Network allows franchises to share data.

Now, for the unintended consequence. I am pretty damn sure that Century21.com is not participating in the real estate network to drive phone calls to Debbie Jamison of Patterson Realty who happens to belong to an MLS that installed a new description field for listing syndication. In this case, a reasonable consumer would more likely contact Debbie than any Century 21 agent.

There are a lot of ways to fix this. Among them would be for ListHub to be provided with both description text fields in the MLS feed instead of only the syndication field. This is probably the best solution, too. In the absence of making a modification to the data rights for the Franchise Real Estate Network, the entire program may unravel and revert back to the days when they only displayed listings from franchisees. Clearly, this was not the intentional consequence of modifying the description text for syndication sites in the MLS. Hence – unintended.